From VOA Learning English, this is the Economics Report in Special English.

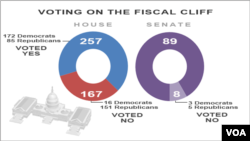

On January first, both houses of the United States Congress approved a plan that will increase taxes for most Americans. But the agreement avoided much larger tax increases that were set to take effect this year.

President Obama signed the bill into law late Wednesday. In a statement, he noted the importance of a balanced approach to the country’s fiscal problems.

"Today's agreement enshrines, I think, a principle into law that will remain in place as long as I am president: The deficit needs to be reduced in a way that's balanced. Everyone pays their fair share. Everyone does their part. That's how our economy works best. That's how we grow."

The combination of higher taxes and automatic budget cuts has been called the “fiscal cliff.” That cliff has been avoided. But much remains to be done. Congress has given itself another two months to decide on how to cut the federal budget. More tax money and budget reductions are needed to cut the federal deficit. That deficit was over $1 trillion last year.

The new law increases the tax rate on individuals with earnings of over $400,000 and on couples with earnings of over $450,000. All working Americans will have some kind of tax increase. This is because the share of Social Security taxes paid by employees will return to 2010 levels, an increase from last year of two percent.

But the largest part of the tax increase will affect those with a lot of investment income and those with very high wages. Taxes on investment gains and dividends, payments from some kinds of securities, will increase. Also, the top income tax rate will go to 39.5 percent from 35 percent. Overall, the effect of the law is simple. It will be the first major tax increase in 20 years.

But the new law means only half of the deficit question has been answered. Taxes provide revenue to finance government operations. But budget cuts reduce costs. And lawmakers will have little time to debate. The federal government has reached its legal debt limit. That is the borrowing limit, set by Congress, for the government. Congress will have to raise the debt ceiling by late February. That will be the job of the 113th Congress, which was seated on Thursday.

In addition, lawmakers will have to make difficult budget decisions by March first. On that date, big, automatic budget cuts, or sequestration is set to take place across the federal government.

On January first, both houses of the United States Congress approved a plan that will increase taxes for most Americans. But the agreement avoided much larger tax increases that were set to take effect this year.

President Obama signed the bill into law late Wednesday. In a statement, he noted the importance of a balanced approach to the country’s fiscal problems.

"Today's agreement enshrines, I think, a principle into law that will remain in place as long as I am president: The deficit needs to be reduced in a way that's balanced. Everyone pays their fair share. Everyone does their part. That's how our economy works best. That's how we grow."

The combination of higher taxes and automatic budget cuts has been called the “fiscal cliff.” That cliff has been avoided. But much remains to be done. Congress has given itself another two months to decide on how to cut the federal budget. More tax money and budget reductions are needed to cut the federal deficit. That deficit was over $1 trillion last year.

The new law increases the tax rate on individuals with earnings of over $400,000 and on couples with earnings of over $450,000. All working Americans will have some kind of tax increase. This is because the share of Social Security taxes paid by employees will return to 2010 levels, an increase from last year of two percent.

But the largest part of the tax increase will affect those with a lot of investment income and those with very high wages. Taxes on investment gains and dividends, payments from some kinds of securities, will increase. Also, the top income tax rate will go to 39.5 percent from 35 percent. Overall, the effect of the law is simple. It will be the first major tax increase in 20 years.

But the new law means only half of the deficit question has been answered. Taxes provide revenue to finance government operations. But budget cuts reduce costs. And lawmakers will have little time to debate. The federal government has reached its legal debt limit. That is the borrowing limit, set by Congress, for the government. Congress will have to raise the debt ceiling by late February. That will be the job of the 113th Congress, which was seated on Thursday.

In addition, lawmakers will have to make difficult budget decisions by March first. On that date, big, automatic budget cuts, or sequestration is set to take place across the federal government.